LTV: How does Bitcoin price affect Loan-to-Value ratio?

Margin Call is under control: How to avoid a forced loan repayment?

24 April 2020

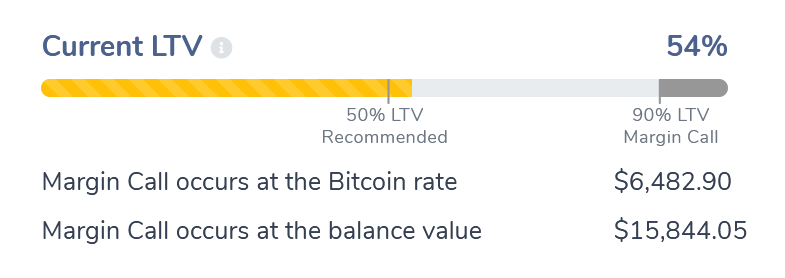

Margin Call is a critical situation in which the borrower’s debt on a loan is forcibly repaid by the user’s collateral because the cost of the collateral at the current bitcoin price does not cover the amount of the used loan limit

How to invest in Bitcoin with minimal risk?

28 May 2020

This is the second part of the articles where you will learn how to protect your bitcoin investment with the help of bitcoin-backed loans on Biterest.