How to multiply return on bitcoin investment by 172%?

FAQ: Answers to the most frequently asked questions on Biterest

14 September 2020

What is the minimum collateral amount? What currencies are available to receive a loan? How long might it take to receive the loan? – you will find the answers to these and the other questions here

Biterest DEMO: Try to receive a bitcoin-backed loan in the demo-mode

3 September 2020

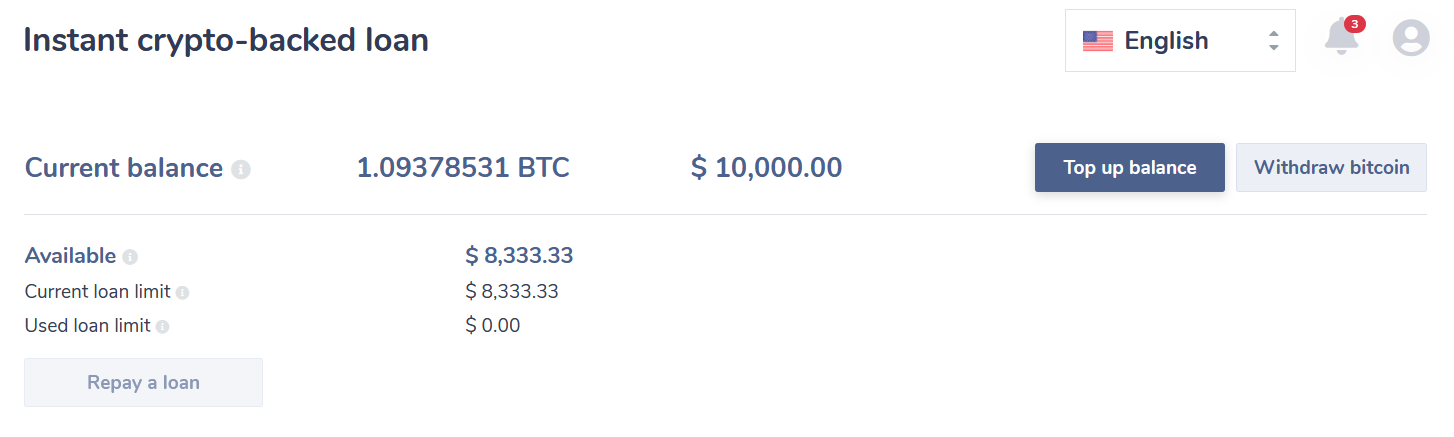

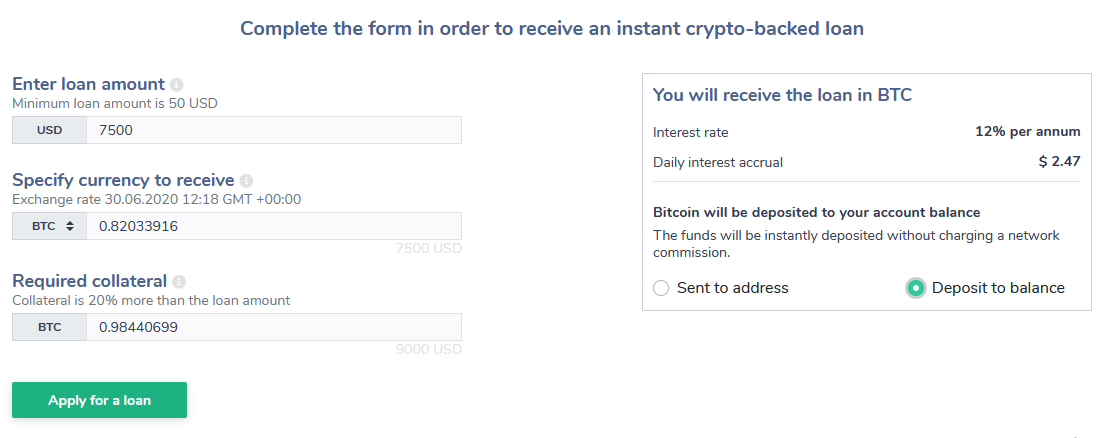

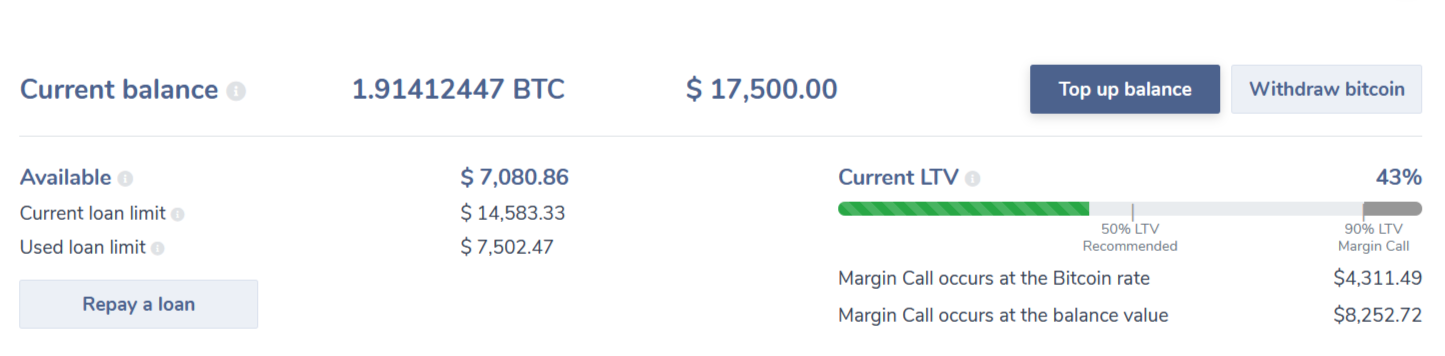

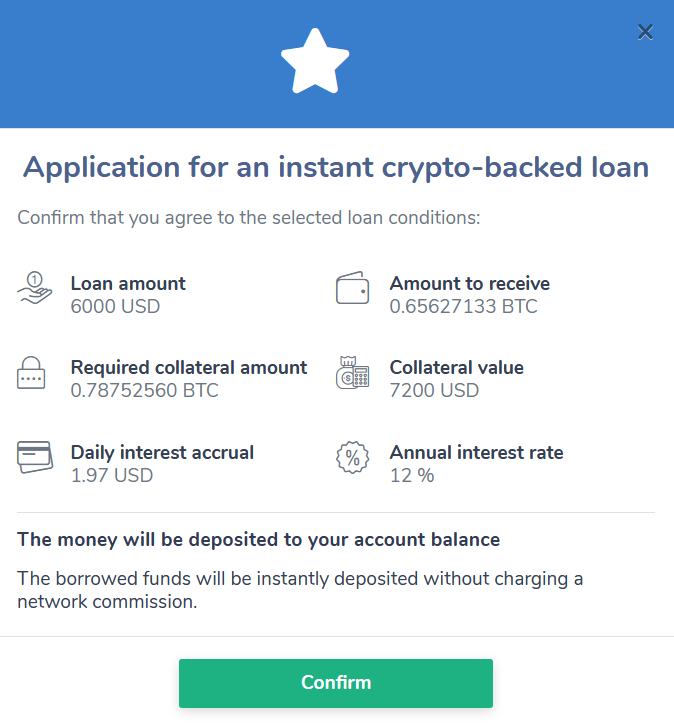

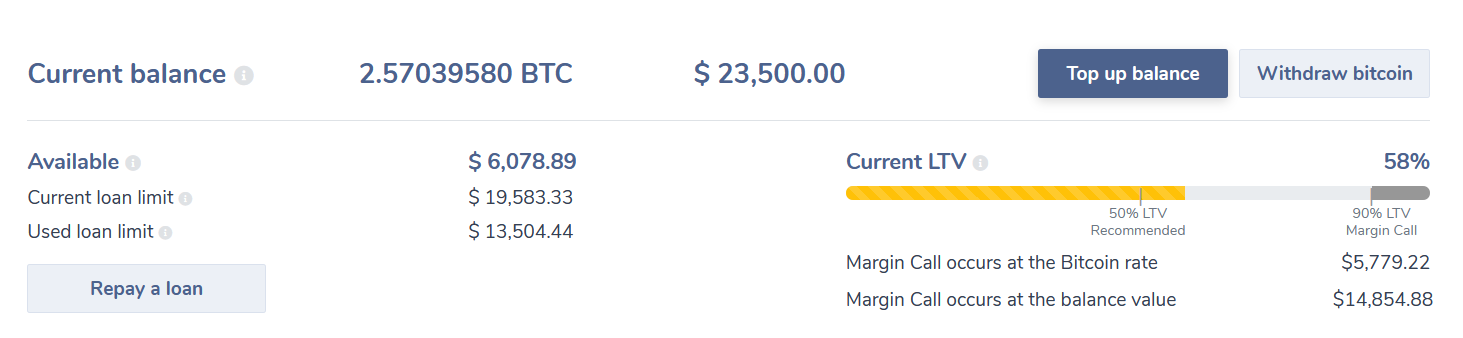

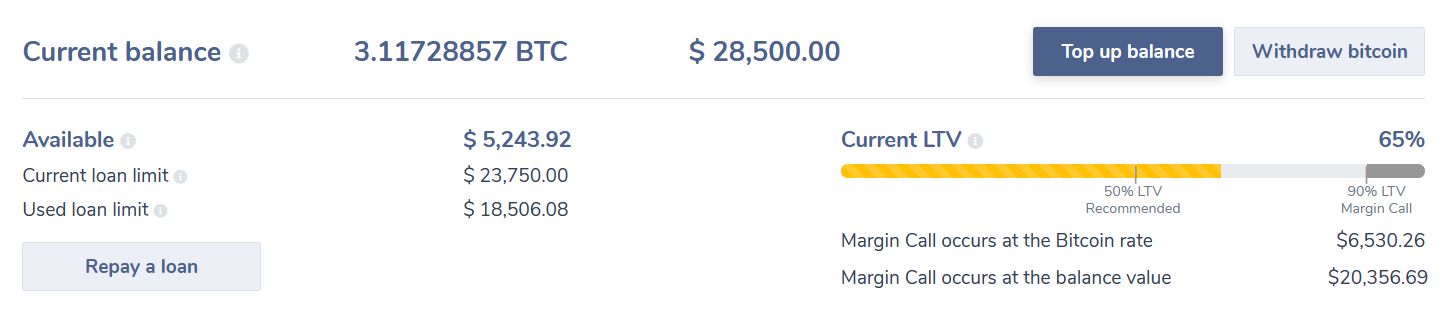

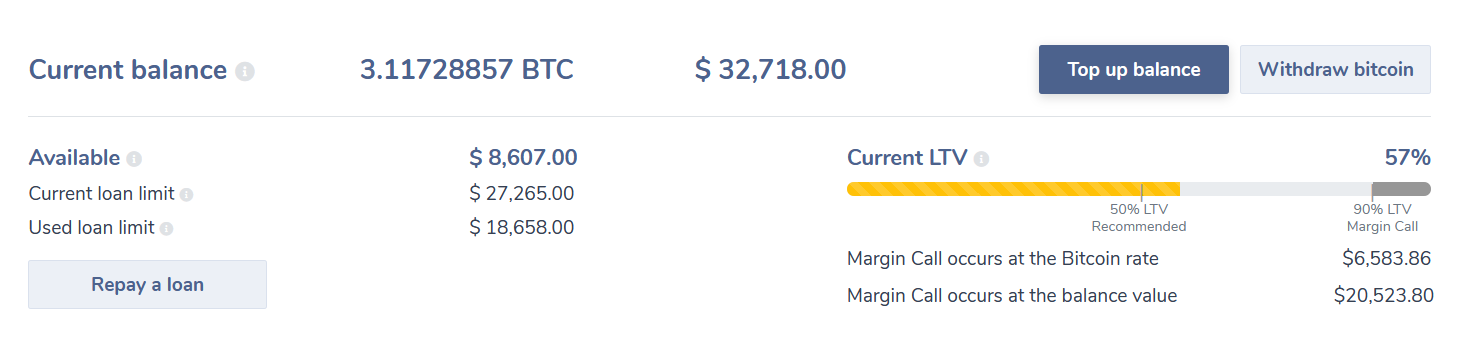

The Biterest credit line has got a unique opportunity for the users to try all the platform functions in Biterest DEMO. In the demo version, your account balance has already been replenished with collateral and you can take your first loan